Talking FEMA

Talking FEMA: Financial Impacts of Flooding

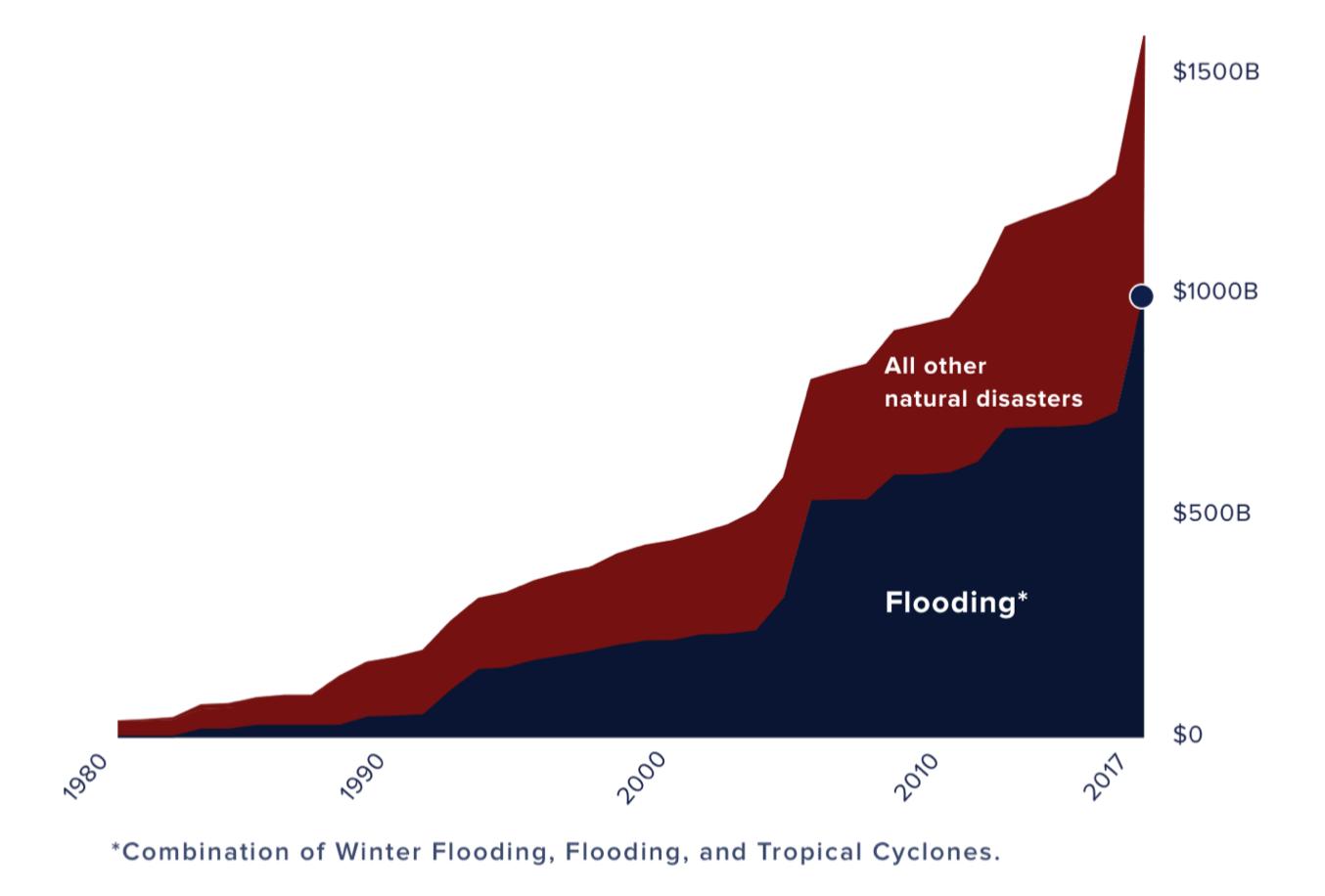

Summary: Data suggests that not only is natural disaster flooding costing more than any other natural disaster but the economic benefits to flood mitigation are enormously positive.

Flooding and Impacts:

Flooding has significant negative economic effects on communities. For example, the Federal Flood Insurance Program estimates that commuites are impacted by each major flood by a loss of 3.5% in employment. Communities generally have to increase the amount of debt they carry and this costs residents and taxpayers more. More floods mean more risk and higher community flood insurance as well.

In addition, flooding also has secondary impact, to such things tourism, family trauma, social disruption, business interruptions and shortage of critical human services. US tourism is 2.9% of the US GDP.

While most coastal real estate is not owned by those in extreme poverty, with the most impact going to middle income households, poor households are impacted more greatly because they generally are not insured and housing is of a poorer quality.

Financial Impacts of Mitigating Flooding;

According to a study in 2006 by the NFIP, benefits and gains associated with disaster recovery, such as construction and jobs do NOT offset flood mitigation. Flood mitigation far outweighs any disaster recovery benefits in the short and long term; According to the NFIP, mitigation not only causes less stress on residents but floodplain management elements reduce costs to government and municipalities.

Flood mitigation including physical mitigation make worthwhile to raise structures above the BFE and is estimated to provide almost $1B in savings annually or 71% savings of costs of not mitigating. This is probably a very simplified impact and secondary impacts are not fully accounted for, but clearly impacts to tourism in coastal tourism communities is enormous and job losses as well as long term trauma and social burdens indicate that flood mitigation is not only a social enhancement but clearly has a strong economic argument for mitigation. Imagine, in a place such as Panama City, Florida, which was impacted by Hurricane Maria, that your entire waterfront was wiped out. There was no water for almost a year, hotels and motels cannot take guests, restaurants are ruined, boats and debris scattered all over the water front for almost 2 years post flood. This is not a rich community, that has now lost a major income generator for two years.

Grants and Funding:

The Stafford Act provides federal assistance. Non residential real estate may also be eligible for SBA loans to cover losses. Tax deductions are potentially an important source of relief as well.

FEMA grants and assistance was valued at over $533M in 2022 so clearly there are multiple levels of federal programs to assist with flood mitigation elevation mitigation, engineering and technical assistance.

According to the graph above by First Street, flooding economic costs far exceed those costs by any other type of natural disaster in the United States.

Houston post hurricane—water no receding quickly creates health and safety as well as negative economic impacts.